PNB Palaash Green Deposit 1204 Days FD vs SBI Green Deposit 1111 Days FD: Everyone is looking for new ways to invest their money for their better future. While many youths are investing in stocks, share bazaars, and other policies, there are many people who want to find the safest way to invest their money and are looking for FD programs in banks. Banks are providing different FD schemes to their citizens which are providing them good interest rates.

However, citizens who want to invest their money in FD programs, are confused to select the good one policy for their candidature. So today we will share with you a comprehensive comparison between Punjab National Bank Palaash green deposit 1204 days FD program and SBI green deposit 1111 Days program. Where we will compare their interest rates for normal and senior citizens, eligibility criteria, maturity period and other features. which will help you to identify most suitable program for you.

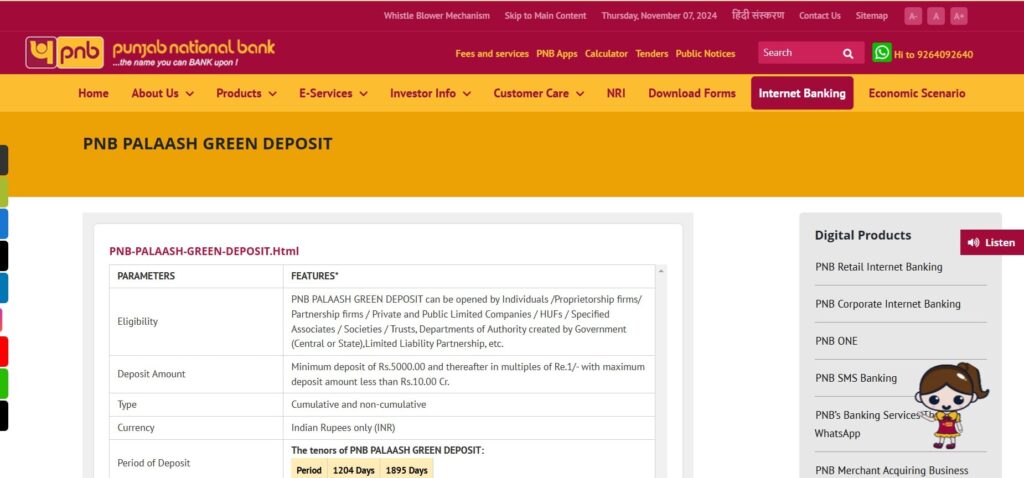

PNB Palaash Green Deposit 1204 FD

PNB Palaash Green Deposit is a Fixed deposit program running by the bank for normal and senior citizens in the country. The scheme is inviting applicants to invest their payment for 2 Different maturity periods of 1204 days and 1895 Days Where applicants can apply according to their need and investment plan. The policy starts with minimum investment of 5000 rupees and after that individuals can increase the limit till 10 crore accordingly.

Interest rates are different for normal citizens and senior citizens were seniors will get extra benefits in the program. If you apply for 1204 day FD program then you need to invest for approximately 3 years and 2 months accordingly. After that you will get your investment along with the additional interest rates.

Apply Online for Free Silai Machine Yojana 2024: Fill Application Form Now – Direct Link

AICTE One Student One Laptop Yojana 2024 Form & Registration Link

Features :-

- Flexibility in interest credit frequency on a monthly, quarterly, half-yearly, annually or at maturity.

- Flexible tenure as per convenience.

- Premature withdrawal is permitted.

- Minimum deposit of Rs.5,000 and maximum deposit amount less than Rs.10 crore.

How to Apply For PNB Palaash Green Deposit 1204 FD?

- Online Visit the PNB website: Go to https://www.pnbindia.in/PNB-PALAASH-GREEN-DEPOSIT.html

- Log in to your PNB account: Enter your user ID and password.

- Look for the “Fixed Deposits” section: This is usually under “Deposits” or “Products.”

- Choose the FD option: Select the type of FD you want to open (e.g., regular, cumulative, step-up).

- Enter details: Fill in the required information, such as deposit amount, duration, interest payout frequency, and nominee details.

- Submit the application : Review your details and submit the application online.

- In-Branch:

- Find a branch near you using their branch locator.

- Bring along your identification proof (Aadhaar card, PAN card), address proof, and income proof (if required).

- Complete the FD application form provided by the bank.

- Hand over the completed form, documents, and the desired deposit amount to the bank representative.

SBI Green Deposit 1111 Days FD

State Bank of India is one of the largest bank in India which is providing banking facilities to their Indians. The bank is providing three options to invest the payment where they can start for 1111 days FD program and if they want to invest for more days then can opt 1777 days and 2222 days FD According to the criteria.

Authority is providing maximum 6.90 interest to the eligible individuals who invest their payment in the green deposit FD program of SBI. Scheme is also providing premature withdrawal of the payment to Applicants. So if you are starting with SBI green deposit 1111 Days then you need to wait for at least 3 years to complete your policy after that you will get your complete payment along with additional interests.

How to apply for SBI Green Deposit 1111 Days FD?

SBI’s existing customers can open SBI FD online via YONO SBI mobile app and internet banking. Alternative, they can visit the nearest SBI bank branch and submit the filled SBI FD form with a minimum deposit amount of Rs 1,000. Individuals can utilize the SBI FD form online and also at SBI branch offices.

Comparison between SBI and PNB green deposit FD

Both banks are providing different features to their customers where you can invest and get good returns after completing the maturity of the policy. We have listed few basic point of comparison in this section including the maturity period of these programs, normal interes and interest for seniors, minimum and maximum limits of deposit compounding etc.

| Feature | SBI Green Deposit | PNB Palaash Green Deposit |

| Period | 1111 Days | 1204 Days |

| Normal Interest Rate | 6.65% | 6.45% |

| Interest for seniors | 7.15% | 6.95% |

| Minimum Deposit Amount | ₹1,000 | ₹5,000 |

| Maximum Deposit | NA | 10 Crore |

| Compounding | Quarterly | Quarterly |

| Premature Withdrawal | Allowed with penalty | Allowed with penalty |

| Contribution | Contributes to sustainable development and green initiatives | Contributes to sustainable development and green initiatives |

SSC JE Admit Card 2024 Download [Link]: Tier 2 Region-Wise Hall Ticket Link

(Released) India Post Office GDS Cut Off 2024, State-Wise Gramin Dak Sevak Cut Off Marks

How much will earn for 5 lakh FD?

If you start investment with Rs 5 lakh rupees in SBI or Punjab National Bank for green deposit program then you will get back 1.11 lakh to 1.27 lakh interest which will be provided additionally along with your premium amount which you have invested for the program. You can check the following comparing table where we have listed the expected earnings for individuals if they invest 5 lakh in these programs

| Features | SBI Green Deposit | PNB Palaash Green Deposit |

| Invest 5 Lakh | For 1111 days (3.04 years) | For 1204 Days (3.3 years) |

| Normal Interest | Rs 1,11,160.13 | Rs 1,17,495.99 |

| Payment for Normal citizen on maturity | Rs 6,20,372.50 | 6,17,495.99 |

| Interest for seniors | Rs 1,20,372.50 | Rs 1,27,594.35 |

| Payment on Maturity for seniors | Rs 6,20,372.50 | Rs 6,27,594.35 |

So you can invest in the program according to your criteria and conditions. How much you invest higher amount, you will get higher interest accordingly which can be collected after receiving your payment once you complete your maturity.